Today, many financial firms find it difficult to carry out trade reconstructions in response to regulatory requests or internal investigations. The data required can sit across dozens of siloed platforms and systems, and even be managed by different teams.

Consequently, obtaining and bringing together the data needed for a trade reconstruction can be highly manual and take a prohibitively long time. However, with tight regulatory deadlines and a need for quicker access to information for investigations, this status quo is no longer suitable.

Compliance functions need an approach that is optimized around data management so that teams can easily bring together multidimensional data and get to risks quicker.

In this blog, we look at the use cases for trade reconstructions, the challenges associated with siloed data and manual processes, and how firms can improve this regulatory practice.

Topics Covered:

Trade reconstruction use cases

Responding to a regulatory request

Under US, UK, and EU rules, financial firms must store and analyze a wide range of data, and if requested by a regulator, retrieve and report specific trade details within a given timeframe. Such a request can arrive at any point and be for a specific trade or order, or for every trade over a particular period of time.

The information required often spans pre-trade and post-trade data as well as market data, voice communications, meetings, emails, and chat – essentially all the details surrounding the financial transactions.

In the US, the Dodd-Frank Act, which is now enshrined in specific rules such as SEC Rule 17a-4 and CFTC rules 23.202 (a) and 37.406, requires firms to respond to such a request within 72 hours. In the EU, trade reconstruction rules are included in MiFID II’s Article 16(7) for all OTC products and exchange-traded market products. These rules were translated to domestic law in the UK post-Brexit.

With strict requirements like these in place and an increased focus by regulators on market manipulation, it is hardly surprising that responding to regulatory requests is the largest use case for trade reconstructions. However, they are also required for other use cases.

Investigating market manipulation surveillance alerts

When a trade or order has triggered a surveillance alert, compliance analysts need to investigate whether any rules were broken and if any wrongdoing took place. This requires them to conduct in-depth investigations including pinpointing all relevant transaction details about the trade or order, the client instructions, and the market context, such as price information and market news if there was any. Furthermore, to tie the investigation together, firms must capture all communications before and after the trade – reviewing calls, emails, and meetings. The final piece requires extracting and storing all the information internally or submitting it to a regulatory body when requested.

Responding to a Best Execution flag or query

Another important use case for trade reconstruction is best execution. While best execution systems can help spot cases where the best execution was not achieved – either by regulatory standards or the firm’s own requirements – determining why this happened often involves further investigation. This is also required if a client queries the execution of one of their trades.

Today’s trade reconstruction challenges

The biggest challenges that firms encounter when trying to fulfill these use cases are grounded in data management and manual processes.

A proliferation of systems and data

Today, because of how regulatory obligations have evolved, and technology has advanced, financial firms have ended up with a patchwork of systems, platforms, and tools to support their trading operations. These include things such as order management, trading, compliance, communications, and CRM systems. While these different platforms make up the information needed for trade reconstructions, they tend not to communicate with one another. Add to that the fact that many of these operations are completed by different people or teams, and bringing together all the relevant data for a trade reconstruction is prohibitively difficult.

Broad data requirements

The data needed to reconstruct a trade or order is broad – trade data can include time stamps, the trading venue, price, quantity, counterparties, identifiers, and more. Furthermore, the market and reference data that firms must bring together can sit in different systems across the business.

Additionally, firms need to bring together the communications that relate to the transaction, which is fraught with complexities. Over the past few years, the communication channels used in financial services have exploded in number. This means that in addition to emails, meetings, and voice communications, firms now need to support chat apps such as WhatsApp, collaboration tools like Zoom and Teams, or workplace organizers such as Slack. It is evident that new communications tools are continually emerging – adding to this challenge.

Manual processes

Given the above challenges, locating all the relevant data in different silos and bringing it together in a timely manner can be extremely difficult, particularly if voice communications are not transcribed, and a wide range of other communications channels have been used. As a result of the plethora of data silos, it can take many days for a firm to audit, identify, and export the relevant information requested by the regulator around a suspicious trade.

And while MiFID II guidance officially says that a trade reconstruction needs to be completed within a “reasonable timeframe,” firms are often only given only 72 hours, like in the US – a deadline many firms struggle to meet. It also means that it can take too long for surveillance analysts to identify any real market abuse and best execution risks the firm is facing.

Putting the data first for effective trade reconstructions

Internal data silos are inhibiting firms’ ability to both meet regulatory requirements for trade reconstructions and carry out internal investigations.

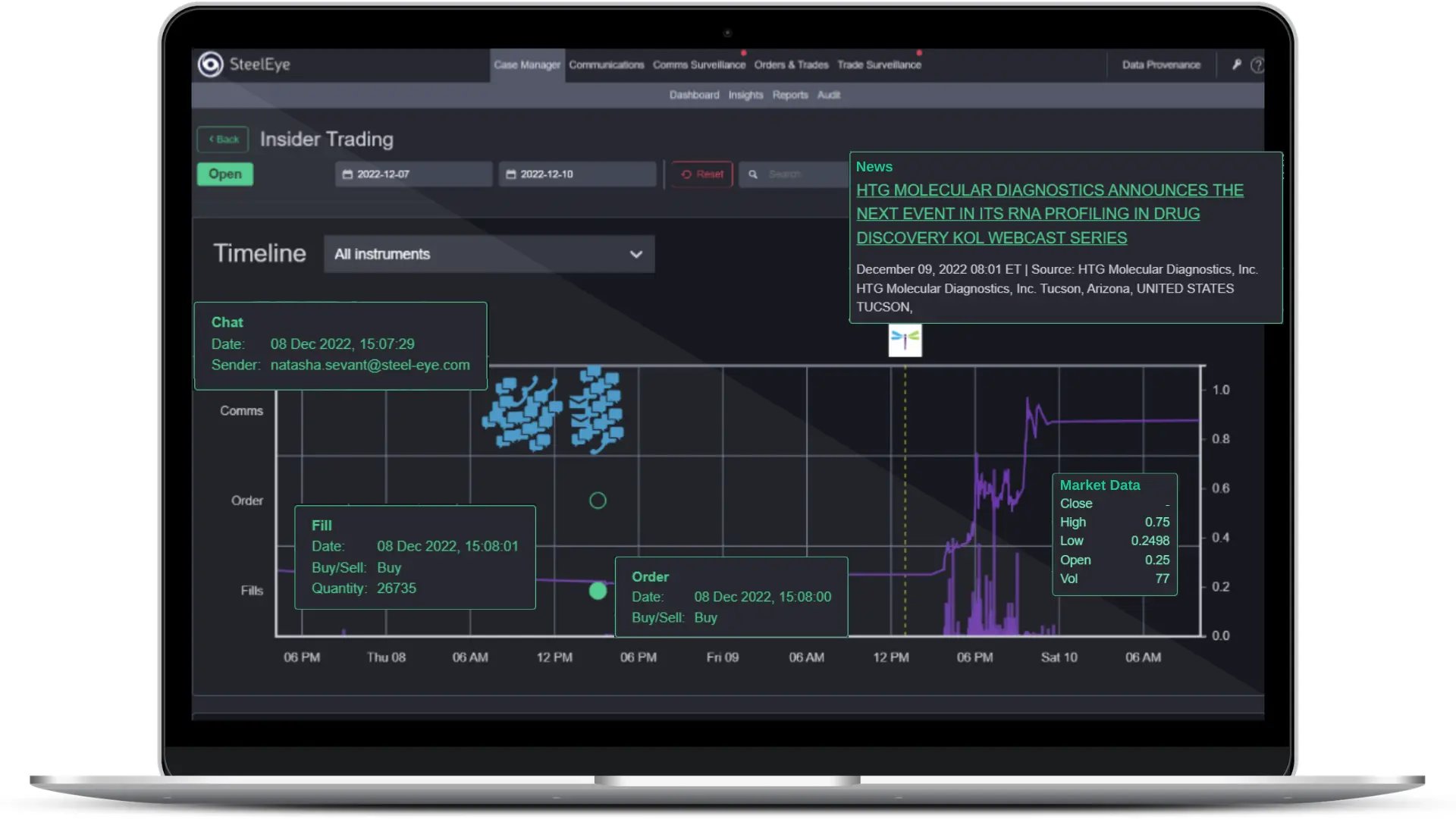

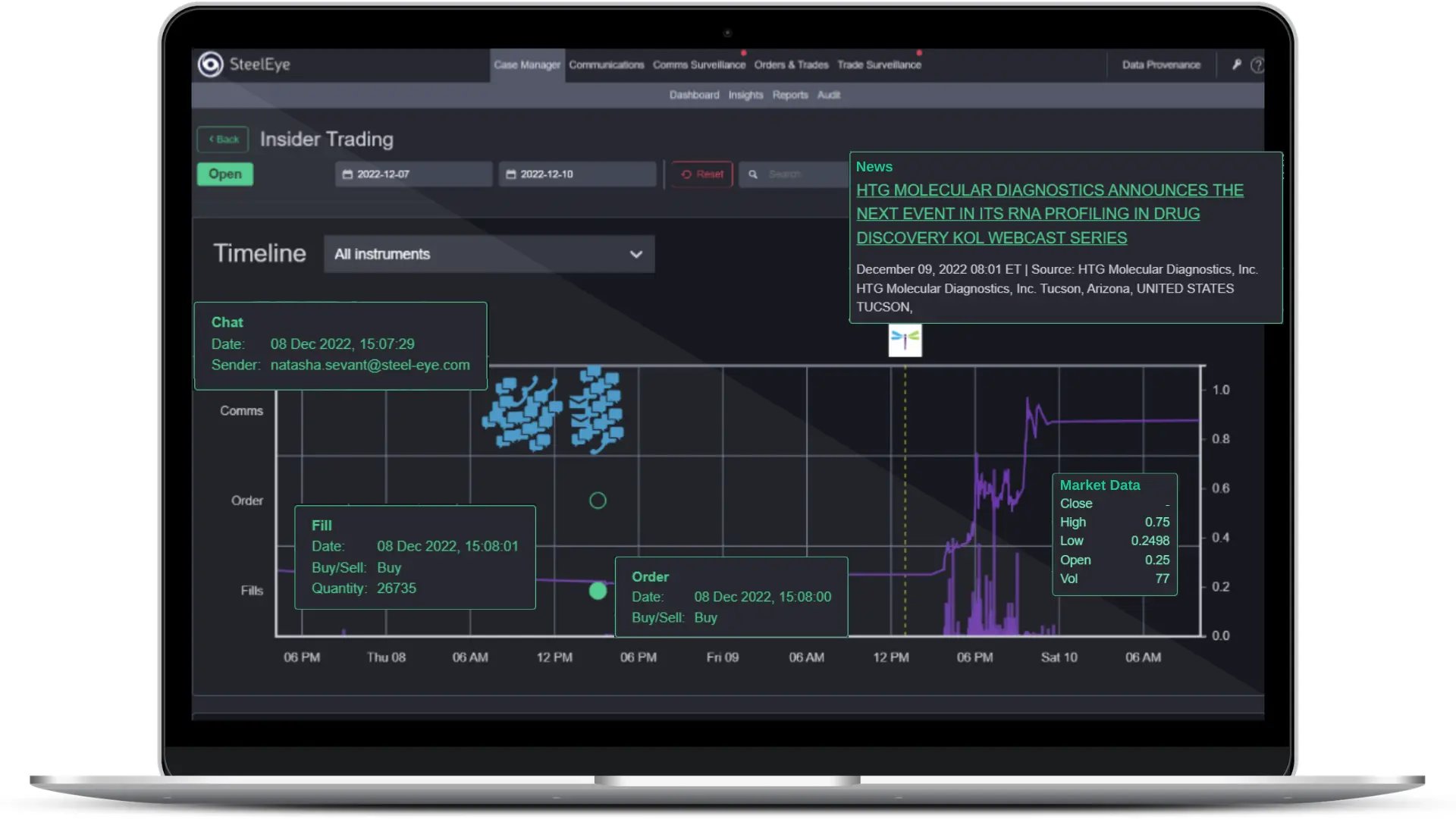

For heads of surveillance, the dream is to be able to provide analysts with a single screen that shows them all the trade and order activity, communications, news, market data, and more on a single timeline, allowing the analyst to focus only on areas of risk and concern.

To achieve this, firms must focus on data first, which requires them to establish better data controls and recognize that the improvement of data infrastructure is not a one-off exercise. In the same way that firms must carry out regular risk assessments and compliance control reviews, they also need regular checks in place of their data infrastructure. This will allow firms to identify areas that can be enhanced to improve risk coverage and manage the efficiency of current controls.

However, to fundamentally solve the trade reconstruction challenge, financial firms need a technology solution that can host their trading and communications data in a single repository. This is often referred to as an integrated or holistic compliance solution.

By bringing together multiple data sources and indexing that data in a centralized data store, the right platform makes locating the data needed for trade reconstruction simple and fast. Such a solution enables firms to bring together different data into a single timeline for a trade reconstruction in only a few clicks. This also allows the platform to build connections between trade and communications, making for a smooth reconstruction process. It can even automate the trade reconstruction process using AI and ML.

The way financial firms manage trade reconstruction today is no longer viable. It takes compliance and trade reconstruction teams too long to get to the information they need.

Firms need a new approach, and they need to get to grips with the data issues that prevent them from meeting today’s regulatory demands and business requirements. Taking a data-centered approach that is underpinned by an integrated compliance mindset can transform the speed and accuracy of firms’ trade reconstruction process, ensuring that the demands of today and tomorrow are met.

The key is choosing a technology platform that can break down data silos and apply easy case management tools for bringing data together. With better data management and the ability to join multidimensional datasets, firms can quickly and easily carry out trade reconstructions. They can also get a more comprehensive view of risk – looking not just at a piece of data in isolation but using other contextual data to make more informed analyses and subsequent decisions.

How SteelEye can help

SteelEye captures all of a firm's structured and unstructured data across any asset class, communication type, and system – unifying it under a single lens. SteelEye’s trade reconstruction solution empowers firms to easily and quickly bring together data from multiple channels, including trades, orders, voice, email, instant messaging, social media, market data, and more, into a case for investigation.

By leveraging artificial intelligence, machine learning, and advanced data relationships, SteelEye makes trade reconstructions effortless. For example, the platform looks at any given scenario or piece of data and brings together all information that is deemed to be relevant, such as related communications, transactions, and independent pricing. This means that firms can dive into any trade or order and immediately see all the related phone calls, meetings, WhatsApp messages, and transaction details.

At the click of a button, firms can add their reconstructed records to an existing case or create a new one. This can then be easily exported from SteelEye's platform and is ready to be escalated internally or submitted to regulators. As a result, your trade reconstruction takes moments rather than days.

LET US SHOW YOU HOW WE turn supervision into Super Vision

Book a demo and we will give you a tour of our platform, so you can see how data-driven compliance drives better results.

Book a demo