Financial services firms are required to comply with a wide range of regulatory obligations, such as trade surveillance, communications oversight, and information archiving, to name a few.

While complying with these rules is already a resource-intensive task, regulatory change, growing data volumes, and operational changes are making it even more challenging for firms to stay compliant. This is compounded by the use of legacy systems and siloed data, which are making the collection, monitoring, and analysis of this data prohibitively challenging.

A new approach is needed for firms to future-proof their operations and stay ahead of regulatory change. The answer lies in improving compliance data management.

In this blog, we explore how a data-driven and integrated approach to compliance can help financial firms meet regulatory requirements more efficiently, while also giving them a competitive edge through holistic data oversight.

Topics Covered:

An increasingly complex regulatory landscape

In the last 10 years alone, we have seen the number of global financial regulations grow exponentially, which has put intense pressure on compliance teams to keep up. And not without struggle, as evidenced by the fact that compliance leaders today rate managing regulatory change as their most pressing challenge.

But why is it such a struggle? In many cases, it is because of disparate, legacy platforms. When responding to regulatory change, many compliance teams have approached each regulatory obligation or deadline in isolation - implementing end-point solutions for each new rule. This has left many with scattered data across a complex patchwork of systems and platforms.

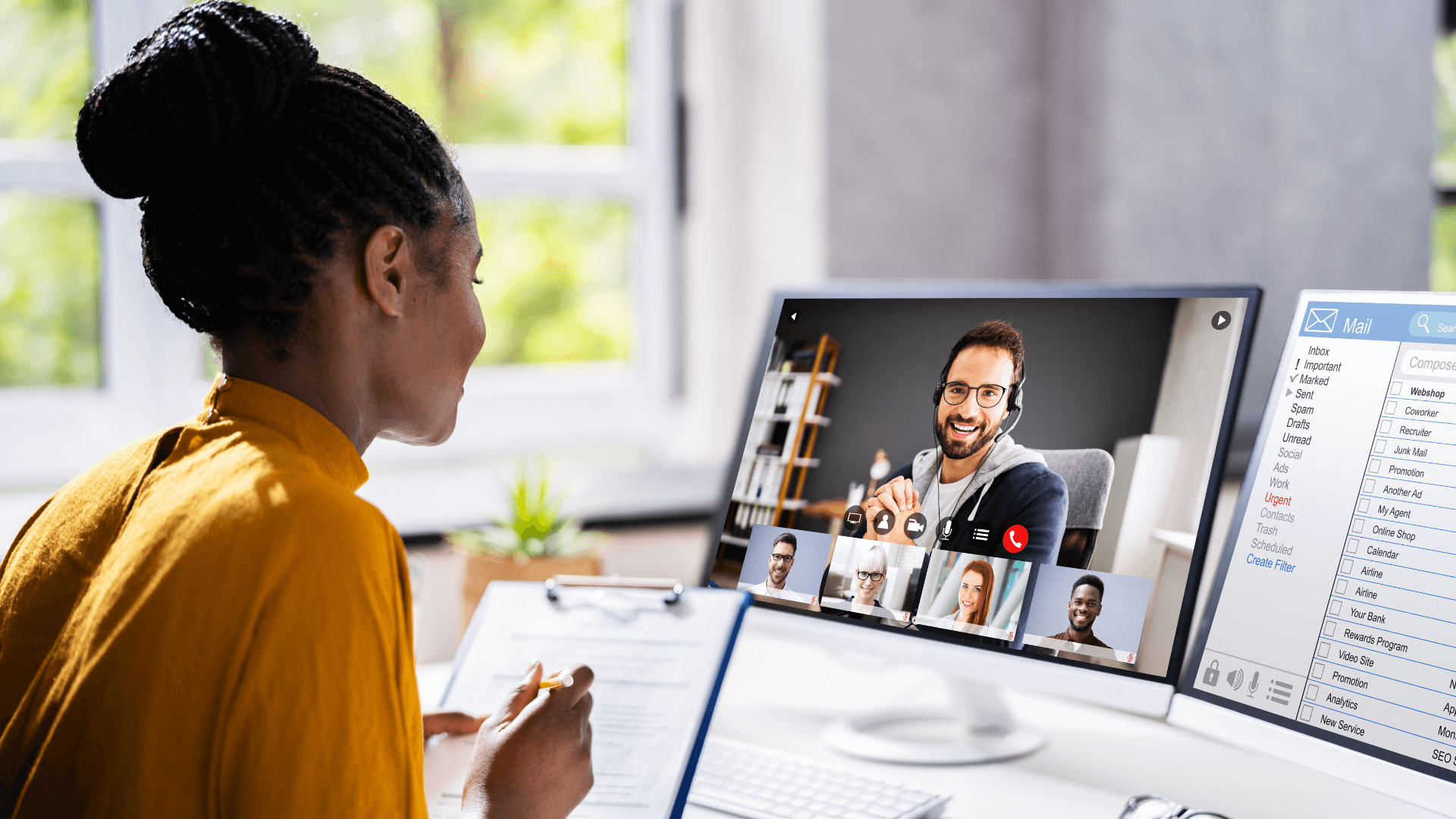

For firms with such a set up, responding to a regulatory change or for example, incorporating new communications channels, can be a huge challenge. It also often results in challenges around data quality, lineage, timeliness, accuracy, and completeness, and makes meeting regulatory rules harder as many obligations require firms to bring together, oversee, and analyze a wide array of data.

Legacy systems are struggling to keep up

An overreliance on fragmented legacy platforms has driven the need for change. Here are some of the challenges associated with legacy technology:

- Adjusting to regulatory change

Compliance teams working with an array of point solutions find it challenging to keep up with regulatory change, technological innovations, and the evolving requirements of clients. Implementing changes across a range of platforms carries increased risk compared to integrated solutions. Additionally, legacy technology simply isn’t very agile.

- Integrating new data sources

Legacy systems typically struggle with integrating new data sources. For example, extending trading coverage to a new asset class or incorporating monitoring of a new e-communications channel can be difficult. Additionally, controlling and monitoring the high volume of communications that take place across an ever-expanding landscape of collaboration channels is a growing challenge, as evidenced by the number of 2022 enforcement actions that centered around the unauthorized use of WhatsApp.

- Ensuring data is complete and accurate

With disparate systems, ensuring that regulatory data is complete, accurate, and securely archived is unnecessarily challenging, as validation checks and audits need to be carried out across a range of platforms. This requires firms to support large teams of people whose sole job is to manage data, which is both costly and time-consuming.

- Responding to trade reconstruction requests

Traditional case management solutions are not able to overlay multidimensional data sets to enable compliance teams to see the whole picture. This provides a huge challenge when trying to pull together relevant information required for regulatory examinations and trade reconstructions – a regulatory obligation with which firms can be given as little as 72 hours to comply.

- Identifying and managing risks quicker

Once a communication or trading alert has been triggered, surveillance analysts need to carry out an investigation to determine if a compliance breach actually took place or if the alert is a false positive. However, one of the biggest challenges surveillance teams face is getting their analysts to the right data, quickly, so they can efficiently investigate alerts. With siloed systems, locating the relevant data for the case and bringing it together takes considerable time. Once this is completed, an analyst still needs to investigate the case to determine if there was any foul play, adding further time and resource constraints.

- Data duplication

The final problem with legacy systems is that they often duplicate a lot of data. When looking at the requirements for record keeping, trade surveillance, and best execution monitoring, you will find that a majority of the data required is largely the same. Therefore, supporting three separate systems for these obligations makes little sense and results in duplicate data storage fees.

Moving towards integrated compliance – why a data-driven approach is needed

Not only is it inefficient to operate multiple siloed platforms, but it is also expensive. There is a huge cost involved when purchasing and maintaining these solutions, particularly if they are on-premise. If the solutions are hosted in the cloud, there are also multiple fees, as well as data storage costs for several parallel data sets.

The alternative to this siloed approach is holistic data management, which represents a considerable opportunity for many firms to work smarter and make efficiency gains.

Benefits of a data-driven compliance approach

Holistic compliance management

By establishing a single data lake, firms can effectively and efficiently meet a number of compliance obligations while gaining complete oversight of their regulated activities. For example, with a data-driven compliance platform, firms can manage both their trade and communications surveillance processes in one place and carry out investigations using integrated data, thereby getting the information quicker while reducing false positives.

For smaller firms, this means the compliance team (or person) can carry out multiple compliance functions all within one platform. For larger companies, where different compliance functions are carried out by different teams, this means data can be shared and the same underlying data methodology can be used - ensuring a consistent approach.

More comprehensive view of risk

With the ability to join multidimensional data sets, firms can get a more comprehensive view of risk – looking not just at a piece of data in isolation but using other contextual data to make more informed analyses and subsequent decisions. For example, if you align trade data with communications and global news, you will quickly be able to determine if say, a trade was made ahead of a significant share, price-sensitive, announcement and whether any suspicious communications were had – indicating perhaps that the trader had insider information. Such an approach should also help compliance teams not only detect breaches but also provide the necessary contextual data to distinguish real risks from false positives.

Future-proofing for operational and regulatory change

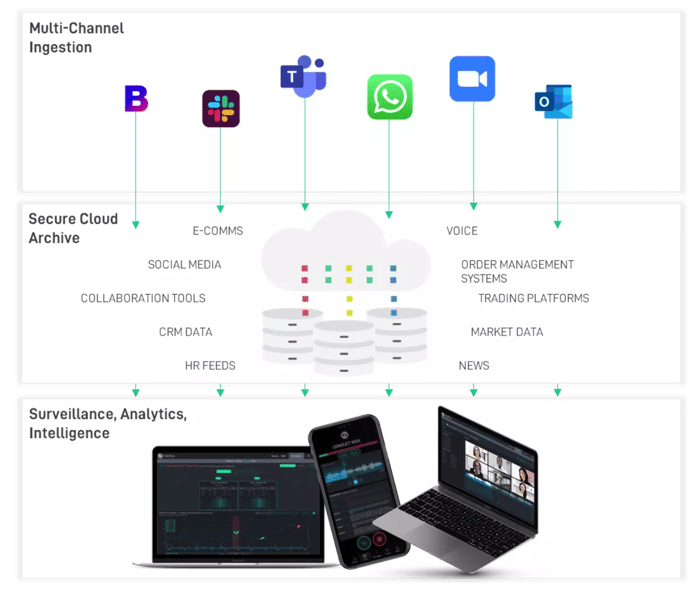

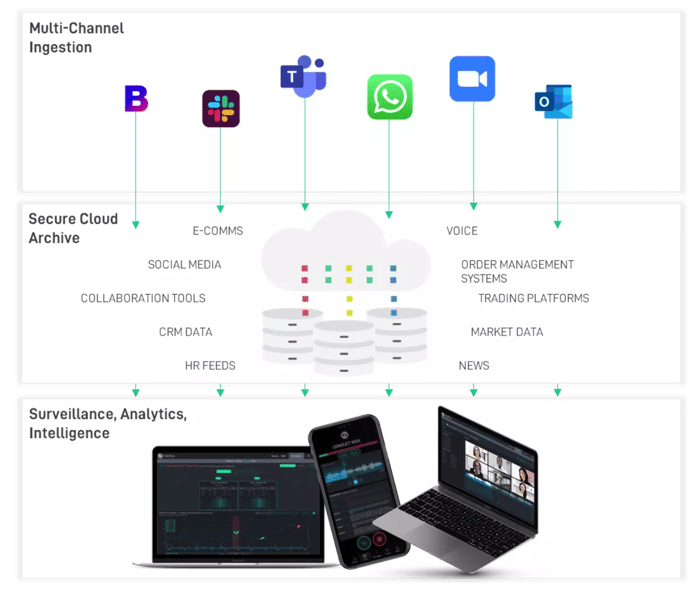

A data-driven compliance solution can easily bring new data channels into the surveillance and compliance processes. When a compliance platform is built around the data, it can adapt quickly – ingesting, indexing, and analyzing new data sources.

Driving alpha from compliance data

There are a number of analytics that can be derived from unified data, which can be of great benefit to a firm beyond compliance alone. By taking a data-driven approach, firms can not only meet increasingly challenging regulatory demands with ease but improve their operational processes overall.

From obstacle to an opportunity

Adopting a data-driven compliance approach can help firms solve a host of challenges associated with regulatory conformity. Beyond this, a data-centric approach gives firms the opportunity to derive additional value from their compliance data through holistic oversight. This enables firms to shift compliance from being an obstacle to an opportunity by enabling them to:

-

Realize efficiencies

-

Automate key processes

-

Improve data accuracy and completeness

-

Get greater visibility over processes and data

-

Gain new insights into where they can better drive operational alpha and improve trade performance

While data-driven compliance has traditionally been difficult to achieve since the compliance function deals with data that doesn’t naturally fit together, advancements in cloud computing and storage have made it possible.

SteelEye's platform specializes in bringing together structured and unstructured data for surveillance and compliance. Once deployed, firms can automate processes using technology, ultimately improving data governance and removing considerable operational risk.

How SteelEye Enables Data-Driven Compliance

SteelEye’s modern and unique data architecture enables firms to combine data from any channel into a single, secure, and compliant repository. The platform has established connectivity to over 50 trade and order data handlers and 85 voice, social, video, and collaboration tools. The platform’s powerful analytics tools deliver intelligence that makes proactive oversight an efficient and effective reality.

SteelEye supports integrated trade and communications surveillance and best execution monitoring, giving firms an all-encompassing solution that lets them unlock actionable insights to sharpen their competitive edge.

Features:

- Dynamic, intuitive dashboard transforms comms, trade, and market data into rich information that fosters action

- Powerful language-based search engine facilitates granular reporting

- Configurable, automated pattern matching, behavioral signals, and other alerts spotlight early warning signs of abuse

- Machine learning and real-time backtesting reduce false positives

To see our platform in action, or to learn more about how we can help your firm gain a competitive advantage, contact our team of compliance experts now.

Contact Us Today