13 April 2023, London – The majority (76%) of financial services firms have seen increased compliance expenditure over the past year, according to the 2023 Annual Compliance Health Check Report from SteelEye, the firm behind the first and only fully integrated surveillance solution.

Heightened regulatory scrutiny across financial services last year, as demonstrated in SteelEye’s fine tracker, which showed record penalties issued by regulators in 2022, meant that firms were under intense pressure to meet compliance standards.

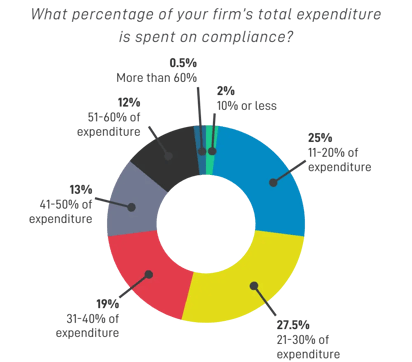

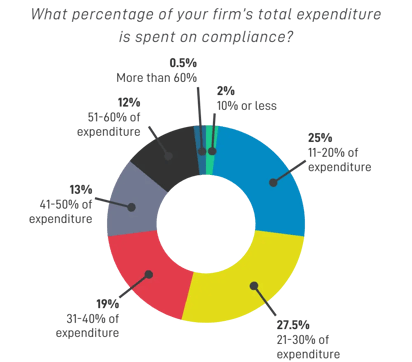

In response, financial firms spent a large proportion of revenue to keep up with the complex regulatory landscape – with nearly a third of firms (27%) claiming that between 21% and 30% of their total expenditure was spent on compliance.

In response, financial firms spent a large proportion of revenue to keep up with the complex regulatory landscape – with nearly a third of firms (27%) claiming that between 21% and 30% of their total expenditure was spent on compliance.

The data adds to the view that compliance teams are struggling to keep up with requirements, as investment in technology to help reduce manual workloads (selected by 38% of firms) and more regulation to comply with (32%) were believed to be the two main drivers of the increased compliance expenditure.

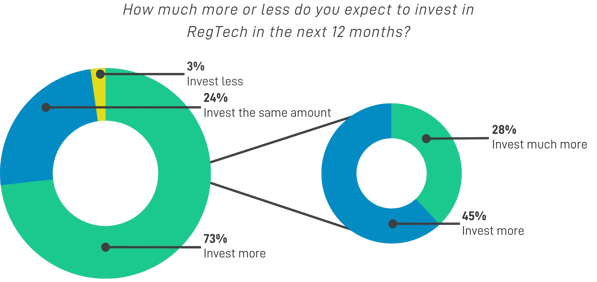

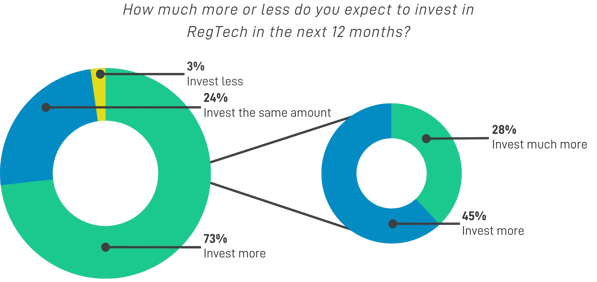

Hiring and keeping the right talent was only selected by 21% of firms, suggesting that compliance professionals are recognizing the need to use a vendor to support compliance operations as regulators become ever-more demanding. This trend is set to continue as more than two-thirds of firms (73%) are expecting to invest more in RegTech over the next 12 months, compared to 44% in 2022, with expectations that some of this investment will go towards external third-party solutions.

With the report also finding that 62% of firms are concerned about traders and portfolio managers taking more risks in a recession environment, investment in compliance will continue to rise as firms look to monitor activity more closely.

With the report also finding that 62% of firms are concerned about traders and portfolio managers taking more risks in a recession environment, investment in compliance will continue to rise as firms look to monitor activity more closely.

The findings come following the scrutiny of governance and risk mismanagement in the wake of high-profile bank failures this year. Against this backdrop, the banking sector is spending the most on technology to support compliance efforts. Sell-side firms – including banks and brokers – are leading in terms of monitoring Microsoft Teams, WhatsApp, and Zoom. 54-62% of banks are monitoring these channels today, with 40-43% having started to monitor them in the last 12 months. This compares to the year before when research showed that only 12-24% of firms, banks, and brokers were monitoring these channels.

Commenting on the findings, Matt Smith, CEO of SteelEye, said, “The recent banking failures are going to add further pressure on compliance teams in the financial sector. While our report shows that 2022 saw huge progress in the sophistication of compliance technology as a result of an increase in investment across the industry, this level of investment will need to continue into 2023 to meet the mounting regulatory pressure that is expected in the fallout of the recent events.”

SteelEye’s second Annual Compliance Health Check Report surveyed 300+ senior financial services compliance and risk professionals about their current compliance concerns, priorities, and spending.

About the research

The research was conducted by Censuswide, with 309 Senior Compliance Decision Makers within Financial Services Firms between 07.02.2023 - 15.02.2023. Censuswide abides by and employs members of the Market Research Society, which is based on the ESOMAR principles, and are members of The British Polling Council.

Regional split:

About SteelEye

Turn Supervision into Super Vision. SteelEye is the first and only fully integrated trade and communications surveillance solution. We empower financial firms with the data-driven tools and complete insights they need to focus on what matters, all from a single platform.

State-of-the-art algorithms and intelligent alerts proactively detect market manipulation and compliance breaches, while our holistic data model – which combines communications, trades, orders, news, and market data – provides intelligent insights and deep analytics. Founded in 2017, SteelEye has offices in the UK, North America, Portugal, and India. For further information, visit steel-eye.com.

DOWNLOAD THE REPORT

In response, financial firms spent a large proportion of revenue to keep up with the complex regulatory landscape – with nearly a third of firms (27%) claiming that between 21% and 30% of their total expenditure was spent on compliance.

In response, financial firms spent a large proportion of revenue to keep up with the complex regulatory landscape – with nearly a third of firms (27%) claiming that between 21% and 30% of their total expenditure was spent on compliance. With the report also finding that 62% of firms are concerned about traders and portfolio managers taking more risks in a recession environment, investment in compliance will continue to rise as firms look to monitor activity more closely.

With the report also finding that 62% of firms are concerned about traders and portfolio managers taking more risks in a recession environment, investment in compliance will continue to rise as firms look to monitor activity more closely.