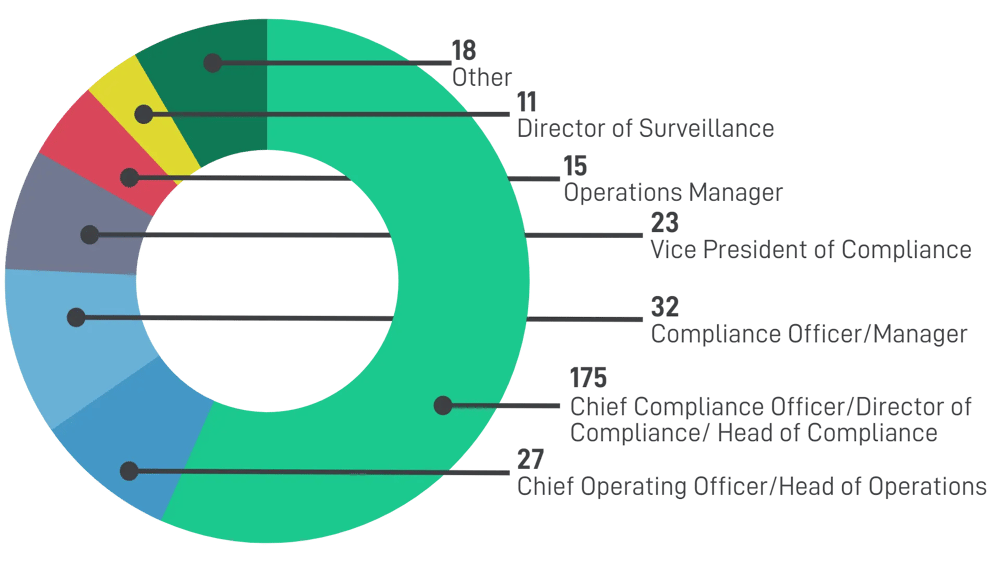

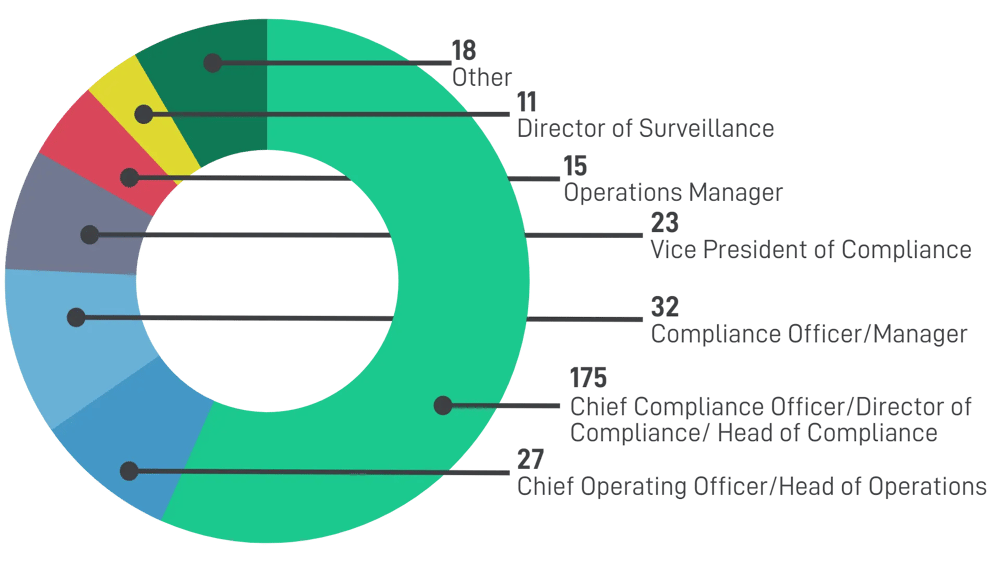

Surveying 300+ senior compliance decision-makers

Download the report to get the latest insight into the state of financial services compliance.

.webp?width=900&height=792&name=The-State-of-Financial-Compliance-2023-Annual-Compliance-Health-Check-Report-SteelEye%20(1).webp)

Why not share the report with your network? Share on LinkedIn Share on Twitter

2022 was, in many ways, an unprecedented year when it came to global events, and the resilience of the financial markets was truly put to the test.

As the world started to recover from the impacts of the Covid-19 pandemic and related lockdowns, the devastation of the Russia-Ukraine war rippled through the world, triggering widespread supply chain issues and driving up energy prices. And it didn’t stop there.

The UK Government saw three different prime ministers in 2022. The crypto market sustained huge blows after the collapse of one of its leading players. Wall Street was hit with fines amounting to $2 billion for the use of unauthorized communications channels.

Inflation soared across most of the world’s economies, with many countries at risk of economic recession.

In response, interest rates have increased, which, combined with the war in Ukraine, continues to weigh on economic activity.

All of these factors have put mounting pressure on financial firms and their compliance functions.

At the same time, the collapse of SVB Bank and the troubles at Credit Suisse that we saw in the first quarter of 2023 means that the finance industry is under immense pressure to prove it has learned from past mistakes.

SteelEye's 2022 report highlighted the breadth and complexity of the challenges compliance professionals have faced following events like Covid-19 and years of increasing regulation.

While many firms still grapple with these, they now have a new plethora of challenges to contend with, as unveiled in this 2023 Compliance Health Check Report.

The compliance burden is now bigger than ever, as firms face reduced budgets, scrapped technology projects, and smaller teams as a result of the macroeconomic events of 2022. And this comes at a time when regulatory demand is higher than ever.

Consequently and unsurprisingly, compliance costs are on the rise. The majority of financial services firms (76%) reported increased compliance expenditure in 2022, and more than two-thirds (73%) expect to invest more in RegTech over the next 12 months. However, while costs are going up, they seem to be increasing for the right reason. Nearly 2-in-5 firms (38%) attribute investment in technology as the main driver for the increased costs.

In fact, while challenges and priorities vary across firms of different sizes and those operating in different markets or verticals, all signs point to the increasingly important role of technology in solving compliance challenges in financial services.

SteelEye's 2023 Compliance Health Check Report highlights the evolving risks and challenges firms and their compliance teams are facing in 2023. It also provides an overview of firms' priorities, compliance expenditure, and the adoption of technologies like artificial intelligence and machine learning.

Get the complimentary report here >

![]()

45% of firms have scrapped certain technology projects because of the war in Ukraine, increased interest rates, and inflation.

62% are concerned about traders or portfolio managers taking more risk in a recession environment.

71% are investing in eComms monitoring in response to the increased fines over the last 18 months.

19% view managing market manipulation risk by overlaying comms and trades for reconstruction and surveillance as their single biggest compliance challenge.

76% of firms say compliance costs have increased in the last year.

38% believe investment in technology is driving up these costs.

73% of firms expect to invest more in RegTech in the next 12 months.

83% believe financial services firms are in a good position to handle more stringent regulations over the next five years.

Download the report to get the full insights.

For additional information or questions about the report, please contact SteelEye.

US: +1 516-777-9931

UK: +44 203 176 8301

About

LOCATIONS

United Kingdom - 5th Floor, 55 Strand, London, WC2N 5LR

United States - 600 Fifth Avenue, New York, NY 10020

Singapore - 600 North Bridge Road #23-01 Parkview Square Singapore 188778

Portugal - Av. da Liberdade 747 1ºD, 4710-251 Braga

India - No. 613, 12th Main, HAL 2nd Stage, Bangalore - 560008

STEELEYE LIMITED, A COMPANY REGISTERED IN ENGLAND AND WALES WITH COMPANY NUMBER: 10581067, VAT NUMBER: 260818307 AND REGISTERED ADDRESS AT 55 STRAND, LONDON, WC2N 5LR.