18 April 2024, London – Compliance teams are facing escalating pressures driven by greater regulatory scrutiny and macroeconomic challenges, according to the 2024 Annual Compliance Health Check Report from SteelEye, the firm behind the industry's pioneering integrated surveillance solution.

The survey found that 56% of firms are investing in communications surveillance, and despite the continued rise in regulatory expectations, expenditure on compliance operations has decreased compared to 2023. This data reinforces the view that compliance investment has been de-prioritized amid other cost pressures linked to geopolitical and economic pressures, such as ongoing global conflicts and persistent inflation.

Despite financial firms expressing intentions to allocate more resources to compliance, the present reality reflects the opposite, with over a third (36%) of firms seeing certain tech projects related to compliance being scrapped amid persistent macroeconomic challenges. There is also evidence of the potential for employee burnout, with, on average, a fifth (21%) of in-house compliance teams burdened by manual and repetitive tasks.

In addition, the data found that the majority (63%) of financial institutions are not currently monitoring WhatsApp for compliance. This comes amid heightened regulatory scrutiny around the use of electronic communications platforms, as demonstrated by SteelEye’s 2023 fine tracker. Last year alone, fines totalling $549 million were levied across Wall Street for failures to maintain records of electronic communications by staff on messaging apps.

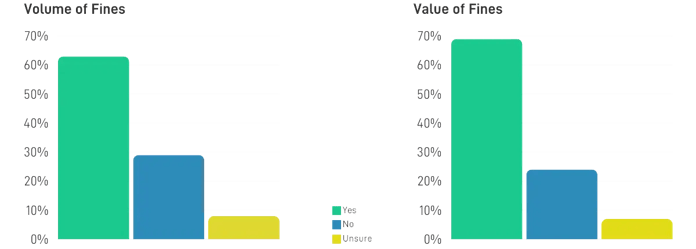

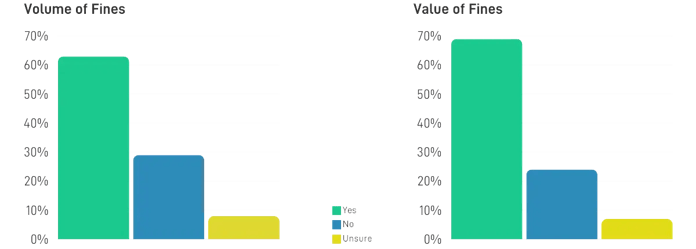

Despite the fact that 69% of firms expect the value of fines doled out by regulators to rise, and 63% expect the volume of fines to rise, the response from financial institutions does not match the needs of compliance teams. Regardless of the optimism from compliance officers to intensify their efforts, the reduction in compliance expenditure will have severe regulatory and burnout repercussions if not prioritized by senior leadership.

|

Do you expect regulators to increase the volume and value of fines for record keeping breaches in 2024?

|

Commenting on the findings, Matt Smith, CEO of SteelEye said, “As regulatory scrutiny intensifies and macroeconomic challenges persist, it’s no secret that the ‘unsung hero’ compliance teams are under unprecedented pressure to meet increasing regulatory demands. With investment in technology solutions not keeping pace with the need for compliance support, senior leadership should be on the lookout for evidence of burnout in their ranks. There’s also a very real possibility that compliance teams will be unable to fulfill their responsibilities as the regulatory burden becomes unmanageable for compliance functions.

“Embracing smarter, more efficient approaches to compliance is essential for navigating the evolving regulatory environment effectively. We now have evidence that those attempting shortcuts have a target on their back that the regulators are not afraid to aim for, meaning compliance teams require the adequate tools to effectively comply before they run out of steam to do so.”

About the research

|

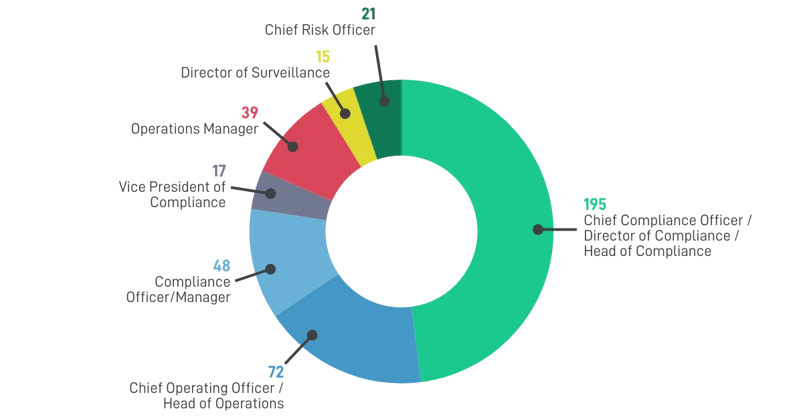

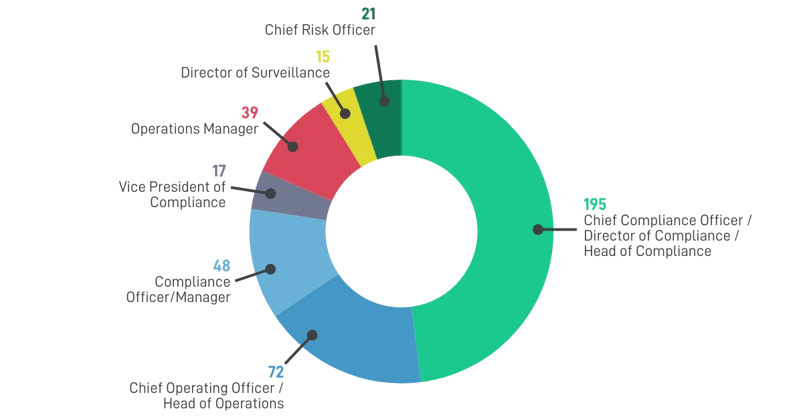

SteelEye’s third Annual Compliance Health Check report surveyed 407 senior compliance decision makers at financial institutions across major financial centers in the US, UK, APAC, and Europe.

|

About SteelEye

Turn Supervision into Super Vision. SteelEye is the industry’s pioneering integrated trade and communications surveillance solution. We empower financial firms with the data-driven tools and complete insights they need to focus on what matters, all from a single platform.

State-of-the-art algorithms and intelligent alerts proactively detect market manipulation and compliance breaches, while our holistic data model – which combines communications, trades, orders, news, and market data – provides intelligent insights and deep analytics. Founded in 2017, SteelEye has offices in the UK, North America, Portugal, and India. For further information, visit steel-eye.com.

DOWNLOAD THE REPORT