When speaking about insider trading, we often hear about situations where traders reap obscene profits, benefiting illegally from positive share price movements. However, we rarely hear about the inverse case - where an insider tip prompts someone to sell their position to avoid financial loss, otherwise known as loss avoidance.

The risks associated with insider trading are an ongoing concern for financial firms and often, the intricacies of insider trading activity are far from straightforward. Under the watchful eye of the SEC, FINRA and other regulators, firms need to be particularly conscientious of their traders’ activity, not only when it comes to the possibility of unethical profit gain, but also when it comes to the avoidance of loss.

The actions of the SEC during 2021 indicate that the Commission's efforts are extending to include new case categories that push the boundaries of insider trading jurisprudence. Examples include cases of questionable trading through anonymized internet activity and “shadow trading”. These rare enforcement cases, as well as the SEC’s plans to add additional restrictions to Rule 10b5-1 show that efforts to combat insider trading are growing and evolving. FINRA also works hard behind-the-scenes to catch insider traders and to bring them to justice using established legal precedent, and is a key SEC partner in the detection of insider-trading violations.

This means that firms are under more pressure than ever to ensure their trading activity is above board. Luckily, advancements in RegTech are making it easier to identify more complex instances of insider trading, such as loss avoidance.

Topics covered:

What is Loss Avoidance?

As an action within the overarching practice of insider trading, loss avoidance occurs when a trader holding stock in a particular asset or instrument receives, or is privy to material non-public information (MNPI) that indicates the stock’s price is about to drop. As a result of this inside information, the trader sells their stocks, thus avoiding any losses they would otherwise have incurred as a result of the stock price falling.

A famous example of loss avoidance is the case of Martha Stewart from the early 2000s. Stewart had owned stocks in a biopharmaceutical company, and 24 hours before it was announced publicly that the FDA was not going to review the company’s trial treatments for cancer, she sold almost 4000 of her shares and avoided a loss of thousands of dollars as a result of the company’s falling share prices. The SEC, noticing the incident was suspiciously coincidental, filed a civil complaint against her with charges of insider trading, securities fraud, and obstruction of justice. She was found guilty of obstruction of justice and making false statements to a federal investigator, and was sentenced to five months’ imprisonment, five months’ house arrest, and a $30,000 fine. After attempts to appeal the sentence and back and forth negotiations, the SEC settled the civil case against Stewart in 2006 and she agreed to pay a penalty of three times the losses she avoided, amounting to $195,000.

Often, insider trading is conducted behind the veneer of complex and smart investment strategies, but these plans, when scrutinized, can reveal to be ploys to avoid loss. While long and short position strategies, for example, are leveraged by investors for potential profit-making, instances where these strategies are misused are usually cause for concern, as sudden and unjustified changes to a position may mean insider trading has taken place for avoidance of loss.

Some stock-buying strategy scenarios that can be indicative of loss avoidance or potential insider trading include:

- Moving from a short position to a flat position, which entails an investor, originally intending to gain profits through a short sell transaction, coming to learn that the short position stocks will increase in price rather than decrease due to some publicly unknown development, and quickly buys the stocks back, closing out their short position to avoid loss.

- Moving from a long position to a flat position, which entails an investor who has bought stocks in a name that they anticipated to be profitable as the stock price grows, coming to learn that the price will in fact decrease and sells their stocks to avoid loss, flattening their portfolio position, much like Martha Stewart did with her stocks.

Why do firms need to identify insider trading and avoidance of loss?

Insider trading is a crime under the Securities Exchange Act of 1934 which was passed after the 1929 stock market crash with the intent, in part, to restore public trust in the markets. Part of this prohibits “manipulative and deceptive devices” in connection with the purchase or sale of securities, including trading a security on the basis of MNPI.

Over the years, Congress has revised the law and the SEC has supplemented it with rules and regulations. SEC Rule 10b-5 states that any act or omission resulting in fraud or deceit in connection with the purchase or sale of any security is unlawful.

Should a firm engage in insider trading, the penalties, jail time and reputational losses at risk can be dire to the firm’s future, and as seen with Martha Stewart’s case, the consequences of trading in an attempt to avoid loss can be even more costly than the loss itself.

To ensure insider trading is identified, acted upon and mitigated, regulated financial firms are beholden to various regulatory obligations under rules by the SEC, FINRA, MiFID II, and FCA. This includes the requirement to oversee trading activities to ensure traders aren’t manipulating the markets. This can extend to the personal dealings accounts of traders who are exposed to sensitive information.

Why is Loss Avoidance an important consideration for firms in the battle against insider trading?

In 2019, the SEC reported that between 2009 and 2014, it had filed hundreds of insider trading cases against entities and individuals whose “illegal tipping or trading had undermined the level playing field that is fundamental to the integrity and fair functioning of the capital markets.” Insider trading, and by extension loss avoidance, is a high enforcement priority for the Commission, and while the Commission can’t prosecute on criminal cases itself, it actively and tenaciously refers cases of insider trading to the Department of Justice. Violators are required to either serve prison time or pay large fines or restitution.

Given its mission to “protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation”, the SEC makes identifying instances of insider trading a priority and financial firms need to be able to monitor for, identify, and prevent instances of insider trading within their organization. However, for many firms, this is done purely for the more traditional instances of insider trading, such as buy or sell orders that have resulted in large profits, and not the avoidance of loss.

Firms that are not monitoring for this could come under increased risk and need to consider how to identify instances where traders have sold their positions within close proximity to a steep share price drop and take remedial action before the SEC or another regulatory body discovers the transgression and enforces legal action accordingly. And although rules may differ slightly between jurisdictions, regulatory bodies across the world are driven to uphold the integrity of capital markets and clamp down hard on any trading activities that threaten to compromise this.

What are the risks of Loss Avoidance going unnoticed?

Loss avoidance, and insider trading of any flavor, when left undealt with, undermines trust in our financial marks and will be detrimental to firms and individual traders in terms of monetary loss, reputational damage and even jail time.

The legal consequences include:

- A stockholder within a company issuing a private lawsuit against the insider for the offense or the company for not having robust enough controls.

- Monetary penalties (up to three times the profit gained or loss avoided)

- Bans for the insider from serving as an officer or director of any public company, either permanently or for a set period of time.

- Bans prohibiting the insider from trading in securities, either permanently or for a set period of time

- A criminal felony prosecution.

It’s worth noting here that in the United States, individual perpetrators can’t be defended by their company against an insider trading violation and that the individual will need to bear the costs of defending themselves, which can be very costly in addition to the reputational losses they will already be suffering.

Unnoticed avoidance of loss can also impact the corporate behavior, conduct and culture of an organization. The more lax a company is with how it enforces its compliance, the higher the risk of loss avoidance and insider trading overall.

Psychologically speaking, loss aversion does lead to biases in human behavior, as people are naturally averse to the risk of loss, and this may influence the trading decisions individuals make. The temptation to avoid loss needs to be tempered with education around the consequences of loss avoidance, in terms of regulatory compliance and the obligation financial professionals have to act ethically. Building a culture of transparency and accountability can encourage individual traders to act more ethically.

How can financial firms reduce insider trading risks and identify loss avoidance?

To address loss avoidance, firms need to prioritize cultivating the right culture and developing suitable technology-enabled processes. Regarding culture, traders need to be trained to help ensure compliance.

In terms of identifying instances of loss avoidance, adopting technology-enabled processes and a holistic approach is crucial. This needs to be customizable to account for a firm’s unique business type and trading strategies, and the right algorithms need to be set up to identify insider trading offenses.

Insider Trading Agorithms

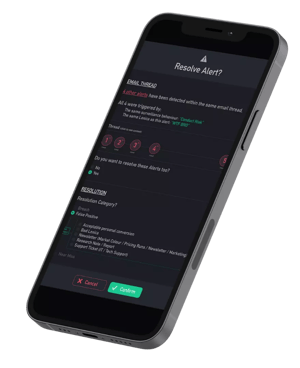

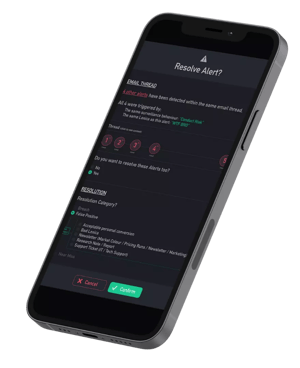

A holistic insider trading algorithm must have access to trading data, market data, electronic communications and relevant market news. Insider trading algorithms enable firms to monitor price spikes and instrument price movements to identify out of the ordinary trading behavior around such movements. Surveillance systems can automatically trigger alerts for investigation when large stock sells occur in close time proximity to steep price drops.

Having a news monitoring algorithm in place to complement your insider trading algorithm can help you identify correlations between trades and significant news events, and whether any loss avoidance activity may have occurred. Sophisticated algorithms like this also monitor user behavior and online data sources to cross-reference and contextualize trade activity for speedier investigations.

Finally it’s crucial to identify the conversations taking place around this time and be able to focus in on relevant emails, text messages, Bloomberg chat rooms and other channels, including voice calls and transcripts. This is where the patterns around illicit information exchange might be lurking.

Learn More About Our Range of RegTech Solutions

With the growing pressure from regulators for effective market abuse monitoring, firms need to implement mechanisms to ensure the conduct of their employees is above board.

Ensuring compliance means mitigating risks of insider trading, including identifying and managing loss avoidance within your firm’s trade activity. While meeting regulatory requirements is a shared responsibility that firms are obliged to educate their employees on, leveraging digital tools like RegTech solutions can greatly benefit your monitoring efforts, and help you more swiftly identify possible insider trading offenses.

How SteelEye can help

How SteelEye can help

SteelEye’s RegTech solution helps firms reduce the complexity and cost of compliance through a suite of holistic capabilities, including monitoring and surveillance tools that help firms identify and mitigate insider trading and loss avoidance risks. With advanced data analytics and trade and communications oversight underpinned by sophisticated algorithms, SteelEye enables firms to monitor all possible trade scenarios through identifying profit and loss-making positions and positive and negative news developments. The granularity of trade detail the SteelEye solutions provide not only help compliance officers proactively identify situations that may be questioned by regulators, but actively empower firms overall to manage loss avoidance and insider trading before any misconduct can occur.

With SteelEye, firms can:

- Bring trade and order data together on a single platform, complemented by market data, news and social media insights

- Strengthen risk detection through intelligent surveillance

- Improve trade activity and behavior oversight

- Consistently demonstrate compliance

- Free up resources and save costs

To find out more about how SteelEye can support your firm’s compliance process, reach out to our team of compliance experts now.

Learn More About Our Range of RegTech Solutions