Tier one firms continue to face large fines as regulators globally crack down on surveillance obligations. Last week, the UK FCA handed out an eye-watering £12.6M fine to the London-based international broker-dealer arm of a US bank for failure to comply with the Market Abuse Regulation (MAR).

Introduced in 2016, MAR requires financial firms to proactively identify and report on suspicious activity, market abuse, and financial crime, for example, insider trading and market manipulation. In its investigation, the FCA found that the offending bank had up until 2018 failed to:

-

properly apply rules aimed at spotting suspicious trading in shares and commodities, and

-

identify gaps in its arrangements, systems, and procedures for trade surveillance.

The regulator deemed that the company had failed to correctly implement MAR rules, leaving it susceptible to market abuse and manipulation.

Commenting on the fine, Mark Steward, Executive Director of Enforcement and Market Oversight at the FCA said:

"The framework for market integrity depends on the partnership between the FCA and market participants using data to detect suspicious trading. By not fully implementing the new provisions when required, [the bank] did not carry its full weight in this partnership, impacting market integrity and the overall detection of market abuse.”

This is the largest fine the FCA has handed out so far in 2022 and comes not long after the FCA's 69th Market Watch Newsletter which highlighted concerns over firms' ability to meet their obligations under UK MAR.

Over recent years, the UK regulator’s attitude and expectations around supervisory oversight and market abuse surveillance have increased. In February, we wrote about why firms need to enhance their UK MAR compliance and the increased risks for firms in terms of penalties and fines, which have now been demonstrated. However, it is reassuring that our Annual Compliance Health Check Report revealed that 45% of firms view trade surveillance as one of their top two priorities in 2022, which increases to 49% in the UK alone.

While this is the first significant surveillance fine in Europe for some time, several large banks have come under scrutiny in the US for failures relating to communications surveillance, with fines totaling over $1B by the SEC and CFTC.

How SteelEye can help:

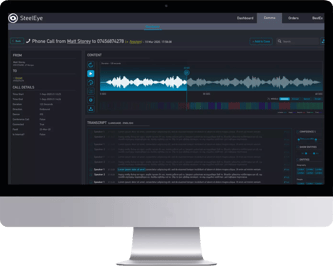

SteelEye provides a futureproofed and modern technology platform for market abuse surveillance. The platform offers a range of highly customizable market abuse behaviors and alerts including wash trading, spoofing, frontrunning, layering, and much more.

With SteelEye, firms can:

-

Bring trade and order data together on a single platform, complemented by market data, news and social media insights

-

Strengthen risk detection through intelligent surveillance

-

Improve trade activity and behavior oversight

-

Consistently demonstrate compliance

-

Free up resources and save costs

|

Let us show you how we simplify compliance

We’ll give you a tour of our platform, so you can see how data-driven compliance drives better results.

|