August 2024, London/New York: SteelEye, the pioneering integrated surveillance provider trusted by financial firms worldwide, has today launched Cross-Product Detection for trade surveillance, a new feature aimed at safeguarding financial institutions against the growing threat of cross-product market manipulation.

Cross-product manipulation occurs when bad actors place orders or trades in one financial instrument to illicitly impact the price of another, either on the same trading platform or a separate one. For example, a trader could place a large trade order for an equity to positively impact the price of a related derivative contract.

The practice often leaves subtle footprints that are difficult for firms to detect, presenting a growing challenge to compliance departments tasked with identifying wrongdoers.

Regulatory authorities are growing increasingly wary of cross-product market manipulation. Over the last decade, several enforcement cases related to cross-product manipulation have been filed in the US and UK. One global bank was forced to pay a $35m penalty after the US Securities and Exchange Commission found that one of the bank’s traders illicitly took advantage of the close correlation between US Treasury securities and US Treasury futures contracts by engaging in cross-product manipulation.

SteelEye’s solution uses sophisticated algorithms to analyze trading activity across multiple instruments and proactively identify cross-product manipulation patterns. By recognizing suspicious correlations between trades in different instruments, the tool helps uncover hidden relationships that might otherwise go unnoticed.

Upon being flagged, the system generates a potential market abuse alert, enabling swift action to protect market integrity. This means compliance teams can determine if an alert is a true concern or a legitimate market activity influenced by cross-product dynamics.

Matt Storey, Chief Product Officer at SteelEye, said: “With financial markets growing increasingly interconnected and wrongdoers deploying ever more sophisticated manipulation tactics, firms must ensure their defenses are as robust as ever. In this context, cross-product surveillance is no longer a ‘nice-to-have’ – it’s an essential tool for protecting market integrity. Watchdogs will remain laser-focused on this issue, and firms that fail to adapt run the risk of intense regulatory scrutiny and hefty penalties.”

About SteelEye

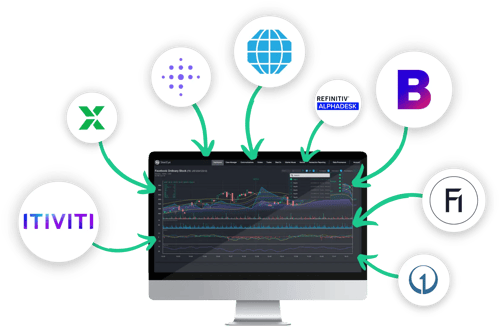

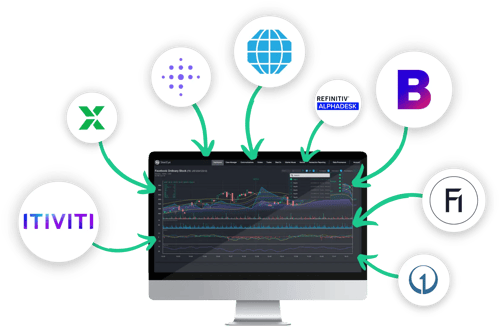

Turn Supervision into Super Vision with SteelEye, the first truly integrated trade and communications surveillance solution. We empower financial firms with the data-driven tools and complete insights they need to focus on what matters, all from a single platform.

State-of-the-art algorithms and intelligent alerts proactively detect market manipulation and compliance breaches, while our holistic data model – which combines communications, trades, orders, news, and market data – provides intelligent insights and deep analytics. Founded in 2017, SteelEye has offices in the UK, North America, Portugal, and India. For further information, visit steel-eye.com.

Emmy Granström

Global Head of Marketing – SteelEye

emmy.granstrom@steel-eye.com

Discover our solutions

Integrated Surveillance | Trade Surveillance | Communications & eComms Surveillance

Record Keeping | Best Execution & Transaction Cost Analysis | MiFIR Transaction Reporting

Let us show you how we enable you to comply with confidence

SPEAK WITH US TODAY