Nominated for the Best Trade-Reporting Solution and Best Transaction Cost Analysis (TCA) Tool for Best Execution

LEARN MORE

Bringing the same emphasis on operational and product excellence in financial trading technology, A-team's European awards reflect the different challenges facing market practitioners and suppliers as they seek to develop trading and data solutions in the rapidly changing European marketplace.

SteelEye is disrupting the RegTech industry with its intelligent data platform which is enabling firm to meet their compliance needs through one comprehensive solution.

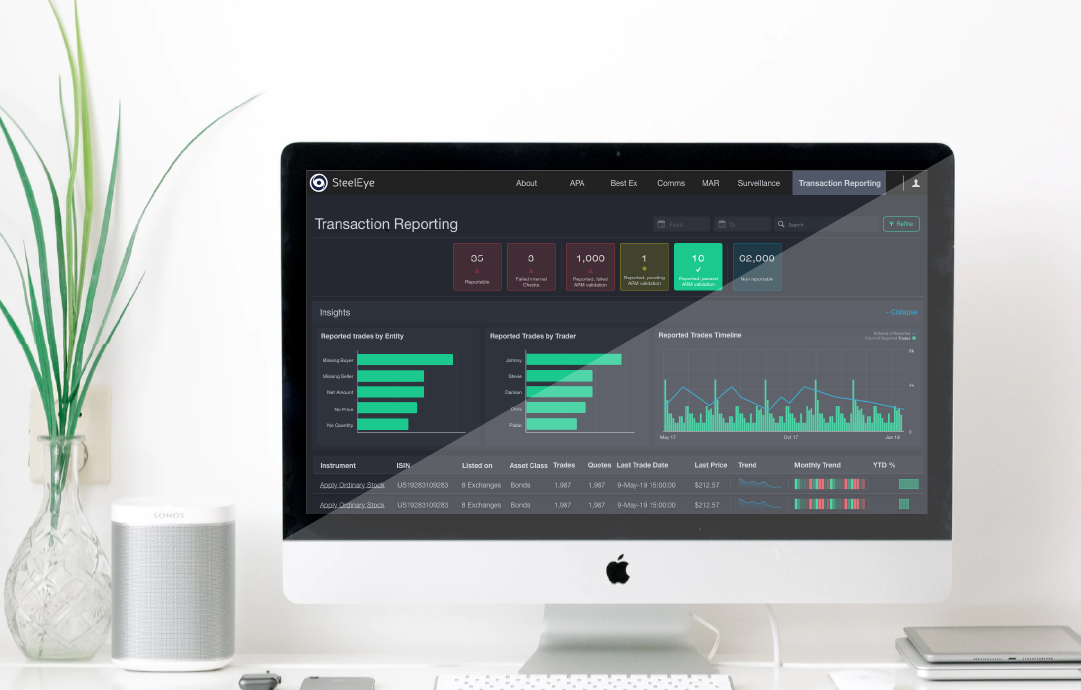

SteelEye’s regulatory reporting suite effortlessly consolidates, normalises and enriches regulatory data in real-time and automatically compiles the required transaction reports. Re

ports can then be scheduled for automatic submission or manually submitted to a trade repository, National Competent Authority (NCA) or Approved Reporting Mechanism (ARM). This high degree of automation enables clients to improve their operational efficiency and free up resource.

SteelEye’s TCA seamlessly brings together client data from a range of sources including order management systems and trading platforms. This data is then automatically enriched, free of charge, with external tick and reference data. SteelEye’s TCA then analyses trading activity against a range of reference points, offering standardised metrics for internal assessment and comparisons against numerous industry benchmarks. This allows clients to easily evaluate their trading activity, gaining comprehensive insight into the relative performance of any post-trade execution.

About TradingTech Insight Awards

Bringing the same emphasis on operational and product excellence in financial trading technology, A-Team's European awards reflect the different challenges facing market practitioners and suppliers as they seek to develop trading and data solutions in the rapidly changing European marketplace.

About SteelEye

SteelEye is a RegTech and data analytics firm that was established to reduce the complexity and cost of financial compliance and enable firms globally to manage their regulatory obligations through a single platform.

SteelEye’s ability to bring together, cleanse, index and analyse structured and unstructured data across all asset classes and communication types enables clients to effortlessly meet their regulatory needs, because when all this data is in one place, compliance becomes both easy and cost-effective. And with everything under one lens, firms also gain fresh insight into their business, helping them improve their efficiency and profitability.

To date, SteelEye has launched solutions for record keeping, trade reconstruction, transaction reporting, trade and communications surveillance, best execution reporting, transaction cost analysis and advanced analytics for regulations including MiFID II, EMIR, Dodd-Frank, SMCR and MAR.