What is Holistic Surveillance? Does it really exist today and where is it going? This is what I discussed with David Cowland from Fidelity and Ian Hollowbread from ING during our recent online panel about Holistic Surveillance.

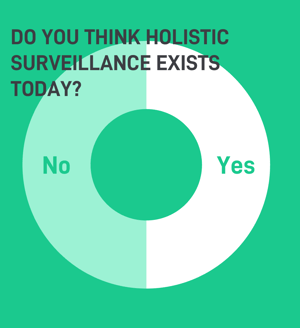

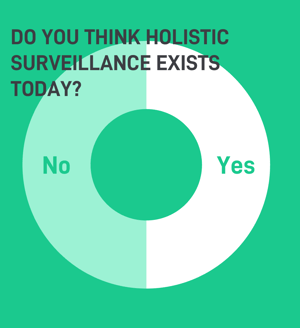

We decided to host this webinar because of the general confusion around what holistic surveillance is. While some people think it means capturing communications and trades on a unified platform, others have argued that it can only exist when a surveillance solution is able to do things like behavioural analytics and meet multi-jurisdictional regulations. To get a better understanding of people's views on the topic, we took the opportunity to ask the +60 market participants who tuned into the webinar a number of questions.

only 50% of participants believe holistic surveillance exists today

When asked if they thought holistic surveillance exists today, 50% answered "yes" and the other 50%, "no". This confirmed our hypothesis that there is no clear understanding of what holistic surveillance really is.

Speaking to our panelists, David and Ian - they argued that holistic surveillance can only be achieved when there is complete transparency across all trading activities and operations. To enable this, firms need the “full” picture at all times which includes communications and other important data sets. Ideally, a holistic surveillance platform would also cover global surveillance regulations, so that only one platform is required.

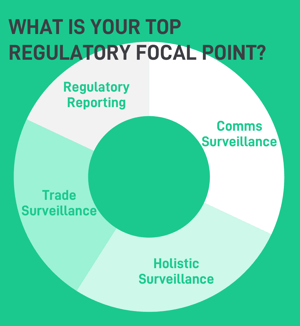

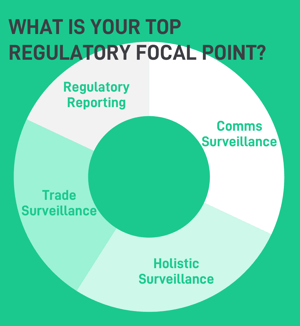

Communications Surveillance is ranked as a top priority, followed by Holistic Surveillance

Similar to the poll we ran during our Market Abuse Monitoring webinar in May, the majority of respondents (32%) still view Communications Surveillance as the highest focal point in their compliance journey. In light of the covid pandemic and the increased use of e-communications platforms during lockdown, this is hardly surprising.

As we discuss in our recent article, it is much more challenging for firms to supervise employees in the current remote working environment, especially when employees may use e-communications platforms which are not connected to firm-wide monitoring tools or permitted in corporate policy. Recent public cases confirm these current challenges, including Morgan Stanley banning the use of WhatsApp and thereafter firing people for misdemeanours relating to the encrypted messaging app.

As we discuss in our recent article, it is much more challenging for firms to supervise employees in the current remote working environment, especially when employees may use e-communications platforms which are not connected to firm-wide monitoring tools or permitted in corporate policy. Recent public cases confirm these current challenges, including Morgan Stanley banning the use of WhatsApp and thereafter firing people for misdemeanours relating to the encrypted messaging app.

What is interesting is that while only 50% of participants think that Holistic Surveillance is possible and exists today, nearly a third (27%) ranked this practice as a top priority.

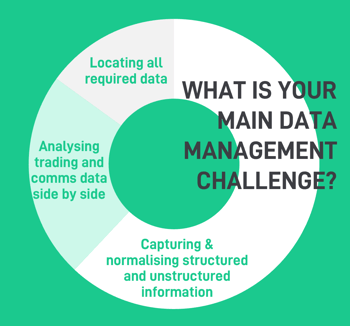

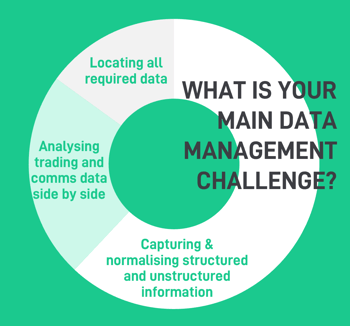

62% of people view data consolidation as a top compliance data management challenge

When asked about compliance data management, 62% of respondent rated the ability to bring together structured and unstructured data as the top challenge, followed by analysing trading and communications data side-by-side.

This challenge is very much driven by the explosion in the amount of information collected and used by financial firms today, where different data sets are often spread across multiple platforms and systems. This has made financial compliance much more challenging because, at the heart of almost all regulatory obligations is the need to bring together, analyse and store vast amounts of data.

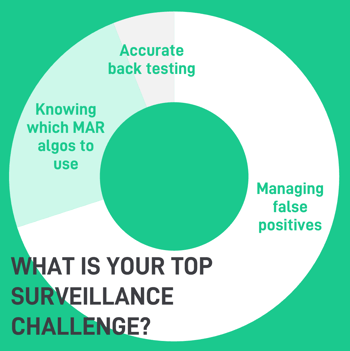

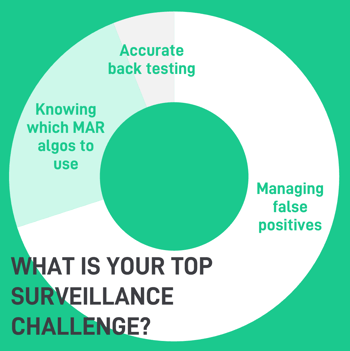

Managing false positives is STILL the top surveillance challenge

When asked about specific surveillance challenges, 70% of participants highlighted that managing false positives is at the top of the list.

This has been a consistent challenge for surveillance teams for years, but has been made worse by the increased use of e-communication platforms, high volatility and irregular trading volumes experienced during lockdown.

As a result of these changes, surveillance teams have been overwhelmed with alerts, which still need to be investigated and closed - even if a high proportion are false positives triggered by changes in the working environment. These problematic alert volumes can happen because software programs often rely on percentage benchmarks to trigger alerts and lack the ability to be tuned.

On this front, lockdown has certainly proved the value of investing in surveillance technology that can adapt with market changes and that uses external factors in its algorithms.

This survey was carried out during SteelEye’s recent Virtual Regs & Eggs – Holistic Surveillance – Busting the Myth which discussed what Holistic Surveillance looks like today, what it should look like in the future, and the practical challenges surveillance teams face that could be eased with a holistic approach.

SteelEye is a trusted compliance platform for MiFID II, EMIR, Dodd-Frank, MAR, SMCR & more. Established to reduce the complexity and cost of financial compliance, SteelEye enables firms globally to manage their regulatory obligations through a single platform.

SteelEye’s ability to bring together, cleanse, index and analyse structured and unstructured data across all asset classes and communication types enables clients to effortlessly meet their regulatory needs, because when all this data is in one place, compliance becomes both easy and cost-effective. And with everything under one lens, firms also gain fresh insight into their business, helping them improve their efficiency and profitability.

To date, SteelEye has launched solutions for record keeping, trade reconstruction, transaction reporting, trade and communications surveillance, best execution reporting, transaction cost analysis and advanced analytics for regulations including MiFID II, EMIR, Dodd-Frank, SMCR and MAR.

.jpg)

As we discuss

As we discuss