Helping financial institutions comply smarter by fully leveraging their data

MiFID II has had a significant impact on the operations and profits of brokers. The plethora of new obligations and ongoing changes to the regulatory landscape has made it more difficult for financial institutions, let alone brokers, to meet their requirements.

For many firms, this has resulted in a patchwork of regulatory solutions and systems with time-consuming, manual and error prone workarounds. This has added unnecessary complexity to the already onerous compliance process and left firms vulnerable to sanctions, fines and reputational damage. It has also driven up the amount of resource brokers have had to invest in compliance, lowering their margins.

But compliance doesn’t have to be just a cost! When leveraged correctly, the requirement to store data imposed by the various regulatory regimes can become a considerable opportunity for firms to realise synergies, gain insight into their performance and strengthen their competitive advantage.

“Firms must realise that compliance is not a one-off process. By treating it less as a box-ticking exercise and more as a long-term strategy, benefits can go way beyond regulatory conformity. With the right tools and technology to make sense of and consolidate data, compliance can become a genuine opportunity to gain business insight and operate more competitively.

Matt Smith, CEO of SteelEye

Following the initial scramble to deploy solutions in the lead up to MiFID II, we are beginning to see a shift in the way firms approach compliance. With over a year and a half since the implementation, firms are starting to move away from siloed platforms for mere compliance and towards holistic solutions that provide added value.

End-to-End Compliance

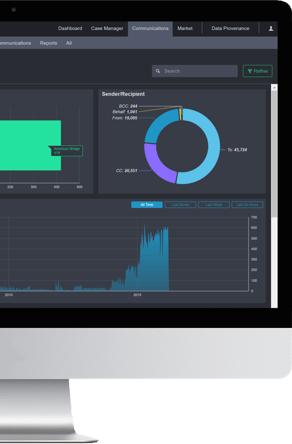

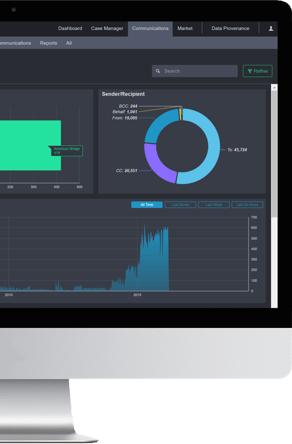

An efficient compliance solution is one where firms can meet a range of their compliance needs effortlessly. SteelEye, the RegTech and data analytics firm, provides such a solution by consolidating trade, order, communications, market and reference data on one platform.

“Some brokers have turned their regulatory obligation into an opportunity by leveraging user friendly technology built for data optimisation. This has enabled them to not only meet their regulatory requirements, but also gain new insights into their business activity, improving their decision making and in turn their performance.

Tom Higgins, CEO of Gold-i

With SteelEye, firms can effortlessly comply with MiFID II and a range of other regulations through a single solution, meeting their requirements for:

Together with FinTech Gold-i, brokers and other financial institutions can integrate their systems with SteelEye in real-time, significantly reducing the time and effort required to transfer data.

As data flows seamlessly from Gold-i into SteelEye, human error is reduced. This ensures the highest degree of data integrity for accurate regulatory reporting. Furthermore, the real-time process brings additional value to the already cost-efficient offering from SteelEye, delivering a fully end-to-end compliance solution for the long-term strategy of financial institutions.

To find out more on how you could simplify delivering compliance and regulatory requirements, book a demo with us today.