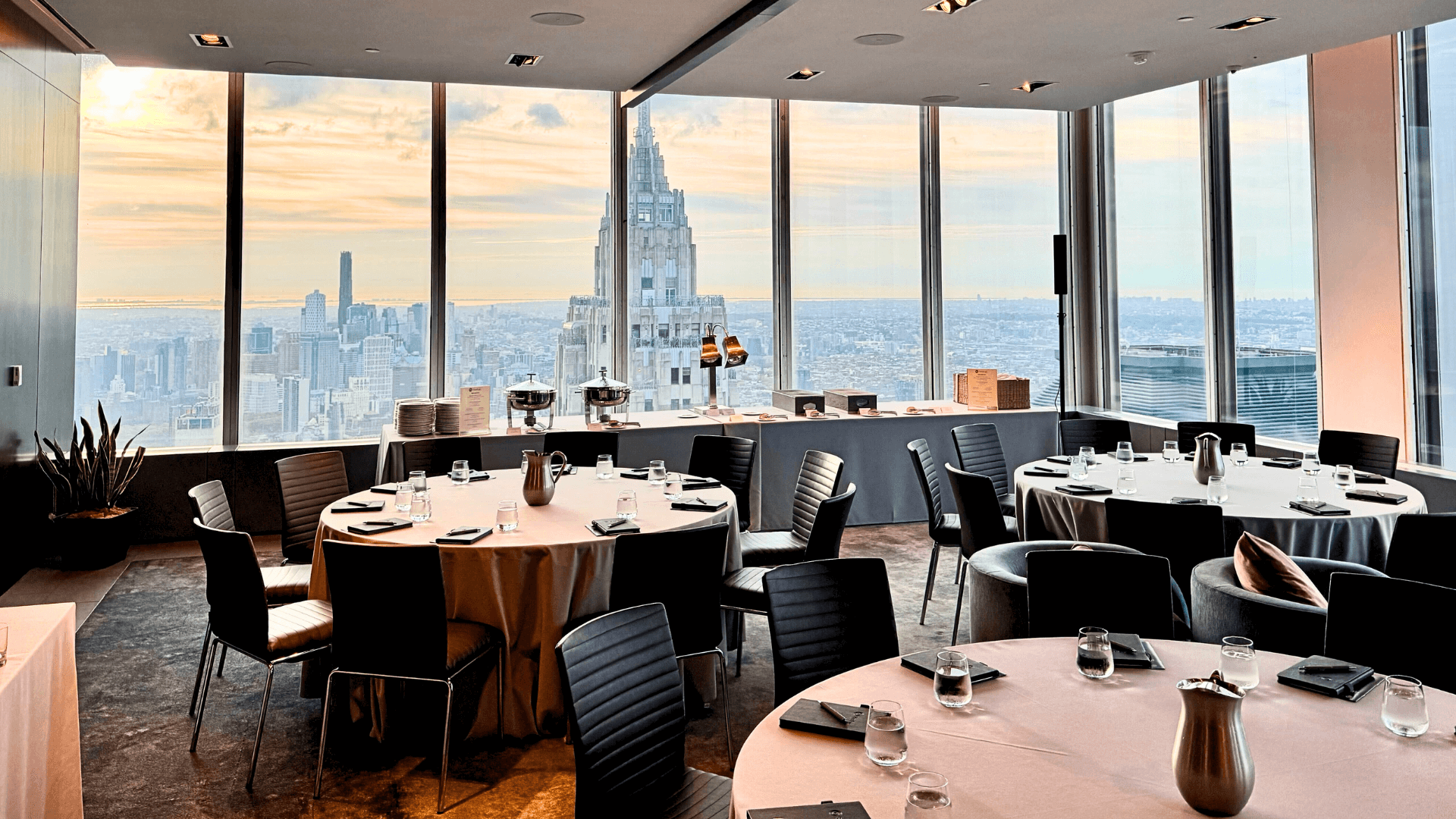

On November 7th in New York City, SteelEye hosted its annual Regs & Eggs event, an exclusive thought leadership forum designed to bring together senior compliance and surveillance professionals to discuss the most pressing trends, challenges, and opportunities within the industry.

While SteelEye has hosted Regs & Eggs annually in London since 2017, the event made its way to New York City for the first time in 2023. Returning for a second consecutive year, the theme for this most recent installment was “Beyond Market Surveillance: Shaping the Future of Financial Integrity."

Hosted 60 floors high against the backdrop of Manhattan's iconic skyline, attendees delved into discussions focused on emerging surveillance challenges, regulatory shifts, and innovative technologies that are reshaping the industry. The morning started with a keynote speech from "The Original Rogue Trader" Nick Leeson, as he provided a riveting account of his role in one of the most notorious financial scandals in history: the collapse of Barings Bank. Following Leeson's session, representatives from Bank of America, Wells Fargo, Barclays, and the National Futures Association (NFA) took to the stage to discuss the ever-changing market surveillance landscape.

If you were at the event and are looking for a refresher of the sessions, or if you were unable to join us and want to know what you missed, this blog will cover some of the key takeaways from the second annual Regs & Eggs New York.

Lessons from the Barings Bank Collapse with Nick Leeson

Nick Leeson's keynote provided a gripping, insider perspective on risk management and the catastrophic consequences of unchecked risk and oversight. Leeson was a derivatives trader whose unauthorized trading led to the collapse of Barings Bank, one of the UK’s oldest financial institutions. In the early 1990s, Leeson was managing both trading and settlement operations at Barings Futures Singapore, a highly unusual and problematic arrangement that bypassed essential checks and balances.

He began making speculative trades in futures, and when these trades resulted in significant losses, he concealed them using a hidden account. Exploiting weak internal controls, a lack of oversight, and the firm’s reluctance to question a top performer, Leeson manipulated records and continued his risky trading. His actions ultimately caused losses exceeding £800 million, and Barings Bank was declared insolvent in 1995. Leeson’s session wasn’t just a recounting of his actions but a reflection on the structural and cultural issues that allowed those actions to go undetected. Some of the key takeaways included:

Leeson’s session wasn’t just a recounting of his actions but a reflection on the structural and cultural issues that allowed those actions to go undetected. Some of the key takeaways included:

The Need to Foster a Culture of Accountability

“I wouldn’t have done what I did if I had a knock on the shoulder,” Leeson admitted.

Despite glaring inconsistencies in data and trade records, no one ever confronted Leeson. This reluctance stemmed from Leeson’s untouchable status as a top-performing trader, creating a dynamic where colleagues deferred to Leeson’s judgment without scrutiny, further enabling his activities.

Leeson emphasized the importance of creating a culture where employees feel empowered to challenge each other professionally. Firms must embed skepticism as a healthy component of their compliance framework, ensuring no individual is above reproach.

The Dangers of Poorly Managed Change

“If change and consolidation programs aren’t controlled and regulated, those changes mean there could be problems,” Leeson warned.

During the years leading up to Barings Bank’s collapse, the organization underwent significant changes and consolidation. These shifts stretched resources thin and eroded oversight, creating fertile ground for mistakes and malpractice.

Leeson noted that firms must be vigilant during periods of significant organizational change, ensuring risk programs remain robust and adaptable to new circumstances. Poor change management can lead to lapses in compliance, as was the case at Barings.

Knowledge vs. Understanding

“There was a lack of understanding at Barings Bank at the time. Everyone was incredibly well-educated and knowledgeable, but they didn’t understand the ways in which I was trading,” Leeson observed.

This lack of understanding extended to Barings’ leadership and beyond. For example, external auditors identified a $5 million discrepancy between London and Singapore’s records during a 1992 audit but dismissed it as a clerical error. Additionally, when Singaporean regulators questioned one of Leeson’s trades, the inquiry was ultimately forwarded to Leeson himself because no one else at the bank fully understood the trading instruments involved.

Leeson underscored the necessity of aligning knowledge with operational understanding. Firms must not only hire well-educated professionals but also ensure they have the tools and training to understand the complexities of modern financial instruments and trading practices.

A Cautionary Tale for Today

Leeson’s story is a stark reminder of how easily oversight failures can lead to catastrophe. While he admitted that his actions were driven by a desire to “survive day by day,” he also acknowledged that they could have been uncovered with even basic scrutiny.

Today, the financial industry has come a long way in implementing safeguards, from advanced compliance technologies to strengthened cultures of accountability. However, Leeson warned that similar scandals remain possible in poorly managed organizations.

Ultimately, Leeson’s keynote served as both a reflection on the failures of the past and a call to action for the future. His story underscores the critical need for vigilance, accountability, and robust technological support in ensuring the integrity of financial systems.

The Market Surveillance Journey:

Insights from Industry Leaders

Following Leeson’s address, a distinguished panel took the stage to delve deeper into the complexities of modern market surveillance. The panel featured representatives from Bank of America, Barclays, Wells Fargo, and the NFA, providing a balanced perspective from regulators, practitioners, and technologists.

The discussion began with the moderator reminding the audience of one of the earliest known cases of market manipulation: the Great Stock Exchange Fraud of 1814, in which false news of Napoleon’s death was circulated to manipulate stock prices. This historical incident, coupled with Leeson’s own experience, underscored the fact that market abuse has plagued financial services firms for centuries, with plenty to be learned from these past instances of market abuse. Yet, as the ensuing conversation highlighted, the modern landscape presents new risks and challenges far more complex than tactics that were deployed 200 years ago. As a result, there must be a hunger and curiosity to proactively mitigate the ongoing threat of bad actors. This was evident in the key topics from the discussion, which included:

Evolving Expectations from Regulators

Evolving Expectations from Regulators

Expectations from regulators have grown in recent years, with a heightened focus on data integrity, transparency, and proactive risk management. The era of reactive compliance is over—today’s regulators demand evidence of active surveillance, backed by comprehensive documentation and proof of implementation.

The real challenge for firms isn’t understanding the rules. The issue lies in cultural and procedural shortcomings that create exploitable vulnerabilities. Written policies and procedures are a starting point, but they mean little if not effectively implemented and consistently upheld throughout the organization.

Regulators are increasingly scrutinizing not just the existence of policies but their practical application. Many firms fall short due to inadequate documentation or relying on policies that are poorly designed, impractical, or unenforceable. Furthermore, regulators are closely monitoring consequences for misconduct, as weak responses embolden those who test the limits.

Importantly, regulators aren’t looking to see firms fail—they aim to encourage improvement and resilience. They recognize that mistakes and limitations are inevitable, but their primary concern is how firms respond and address these shortcomings. Firms that confront issues head-on, invest in better processes, and prioritize fixing broken systems will consistently achieve better outcomes than those that ignore or downplay the problem.

Beyond Policies: Building a Culture of Compliance

Firms must also cultivate a compliance culture that goes beyond written policies. Having the right procedures in place is a foundation, but it’s equally important to foster a culture where compliance is embedded into the daily behaviors and mindsets of employees. This includes regular testing of compliance procedures, ongoing training, and clear communication of the importance of market surveillance.

Firms must foster a culture where employees understand the "why" behind surveillance measures, creating a sense of shared responsibility. This cultural approach is essential for effective surveillance, as it encourages employees at all levels to remain vigilant and proactive in identifying and mitigating risks. By focusing on culture, firms can move from mere compliance to a truly proactive stance on risk management.

Pairing Policies and Culture with Modern Surveillance Technology

Pairing Policies and Culture with Modern Surveillance Technology

Modern surveillance technology is essential for financial services to effectively address today’s challenges. Regulators are looking to firms to modernize their surveillance approaches, ensuring the technology in use is robust, sufficient, and capable of tackling contemporary issues. While they won’t prescribe specific tools, they are aware of various systems’ strengths and limitations, and firms relying solely on outdated or flawed tools risk raising red flags. Additionally, regulators expect firms to deeply understand and explain their technology’s outputs, particularly when significant changes in alert volumes occur.

Heavy reliance on rule-based alerts has proven inefficient, often overwhelming compliance teams with repetitive tasks rather than enabling them to address root causes. Similarly, siloed surveillance systems and disparate data formats exacerbate inefficiencies and hinder a holistic approach.

To thrive, firms must adopt advanced surveillance technology that streamlines processes and integrates data seamlessly. These tools should be explainable and understandable, fostering trust and collaboration between compliance teams, tech experts, and vendors. This includes not just implementing cutting-edge technology but also offering ongoing training and alignment between those using the tools and those selecting them.

The Role of AI in Surveillance and the Need for Explainability

Artificial intelligence and machine learning have become game-changers in surveillance, enhancing the ability to detect anomalies and suspicious behavior with unprecedented accuracy and speed. However, as AI becomes more prevalent, explainability has become a critical requirement. Without this, firms risk compounding existing issues rather than solving them. Regulatory bodies are increasingly scrutinizing how decisions are made within AI systems, pushing firms to ensure that their algorithms are transparent and their outcomes understandable.

While AI can streamline many aspects of surveillance, organizations need to invest in tools and processes that make these technologies interpretable. This requires a balance between advanced technology and a clear framework for explaining how AI-based decisions are reached. Only by making AI accountable can firms ensure they meet regulatory expectations and build trust within their organizations and among their stakeholders.

The Everchanging Skillset Required for Today's Market Surveillance Professionals

As market surveillance becomes more technologically complex, the skillsets needed within compliance teams are shifting. Today’s surveillance professionals require a blend of traditional regulatory knowledge and technical skills, such as data analysis, a deep understanding of statistics and risk probability, and comprehension of advanced digital tools. Additionally, the advancement of AI and machine learning has required firms to seek more intangible skill sets, valuing candidates who are inquisitive, astute, and willing to think outside of the box. As a result, the skill gap is widening, and the industry is struggling to keep up with the demand for more nuanced expertise.

Training and development are vital in bridging this gap. Firms need to invest in ongoing education to ensure that employees are well-versed in both emerging technologies and the intricacies of regulatory compliance. With the field evolving rapidly, recruiting talent with a mix of technology and compliance backgrounds—or actively upskilling existing staff—is crucial for maintaining an effective surveillance operation.

Building vs Buying Market Surveillance Systems

The debate of whether to build proprietary market surveillance systems or to rely on external vendors has been a persistent topic for years in financial services. Each approach has distinct advantages and limitations, depending on an institution’s resources, risk tolerance, and specific compliance needs. While building an in-house solution offers the flexibility to tailor the system to organizational requirements, the cost, time, and expertise required can be prohibitive. Conversely, third-party solutions provide quick implementation and ongoing support, though they may lack the customization necessary for some firms.

Ultimately, while both sides present valid arguments, utilizing third-party vendors for surveillance systems often makes sense for many firms. However, these systems cannot be "one size fits all." They must be customizable to fit each organization’s specific needs. Vendors need to prioritize flexibility, enabling firms to configure the technology to align with their unique compliance frameworks and risk appetites. Equally critical is the importance of fostering a transparent and trusting relationship between vendors and clients. End users must fully understand the technology and its functions, ensuring the solution doesn’t operate as a "black box" but as an accessible, explainable tool. This collaborative approach empowers firms to stay compliant while leveraging the efficiency and expertise of external solutions.

Concluding Reflections: The Road Ahead for Market Surveillance

The insights from Nick Leeson’s session and the panel discussion at Regs & Eggs New York underline the everchanging complexity and importance of market surveillance in today’s financial landscape.

As the financial industry navigates an era marked by technological innovation, increased regulatory demands, and heightened risk awareness, it is clear that a multifaceted approach to market surveillance is needed. Organizations must balance the technical advantages of AI with the necessity for explainability, build adaptable systems that can evolve alongside regulatory expectations, and foster a culture of compliance that permeates every level of the organization.

Regs & Eggs New York showcased the critical challenges and opportunities facing market surveillance. Through Nick Leeson's sessions and the expert panel, attendees gained valuable perspectives on how to strengthen their own surveillance practices. As the industry advances, financial firms must continue to learn, adapt, and proactively engage with the complexities of market surveillance to maintain resilience and compliance in a rapidly evolving environment.

We can't wait to see you all again for Regs & Eggs New York 2025!

Learn more about SteelEye:

Leeson’s session wasn’t just a recounting of his actions but a reflection on the structural and cultural issues that allowed those actions to go undetected. Some of the key takeaways included:

Leeson’s session wasn’t just a recounting of his actions but a reflection on the structural and cultural issues that allowed those actions to go undetected. Some of the key takeaways included: